In today’s time, you can buy your insurance policies through different ways from middle-aged women, toll fee or through the internet. If your insurance needs are just simple like getting insurance for a car, you can even place a policy on your own considering that you know the jargons and legalities in the business. Collision, rental coverage or vacation insurance is too easy to file.

In today’s time, you can buy your insurance policies through different ways from middle-aged women, toll fee or through the internet. If your insurance needs are just simple like getting insurance for a car, you can even place a policy on your own considering that you know the jargons and legalities in the business. Collision, rental coverage or vacation insurance is too easy to file.

However, if you are buying a disability, health or a long term insurance like life or business and home or anything unique like for a finger or so, it is better to consult an agent or a broker for the details behind the terms and to file the right coverage.

To find the right agent or broker, you can ask around for a reputable person. You can keep away from fraud or scams if that agent already has his name rooted in the industry. You can also tell if he knows what he is talking about. Some agents are just sweet talkers using flowery words to lure you in. Many legit agents will have letter behind their names in their business cards. You can check the meaning of these credentials online.

Since you are already on the net, you can check the company as well. The more good reviews the company has, the likely it is legit. When evaluating them, you may very well want to know if it is also capable of staying in the industry for a long time. You would want a company well-established enough to secure and guarantee your lifetime insurance. Their financial strength may very well know indicate that. Generally, insurance companies have letters from A to F attached next to their names. Make sure you read the right reviews and evaluate well.

You can also discuss the pros and cons and know further information regarding the business with your agents by scheduling an interview with them. He should have knowledge, effective communication skills and well-formatted experience.

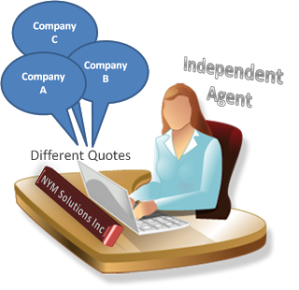

There are two different agents:

- Independent agent – have contracts with several different insurance agencies

- Captive agents– works exclusively for a single company.

About the company

Well-established insurance companies such as Axis Capital, with a group of companies from its main base in Bermuda to its branches to Australia, Singapore, United Kingdom and different states in America have built their reputation with a stronghold for excellence. They have been wildly talked about and greatly admired to the point of imitation to foreign countries particularly in Jakarta, Indonesia, Beijing, China and Kuala Lumpur, Malaysia who also aim to excel in the same field. They only introduce quality service, flexible terms and high-standard customer care with their agents highly qualified in the fields of insurance and reinsurance.